Decoding your municipal tax bill

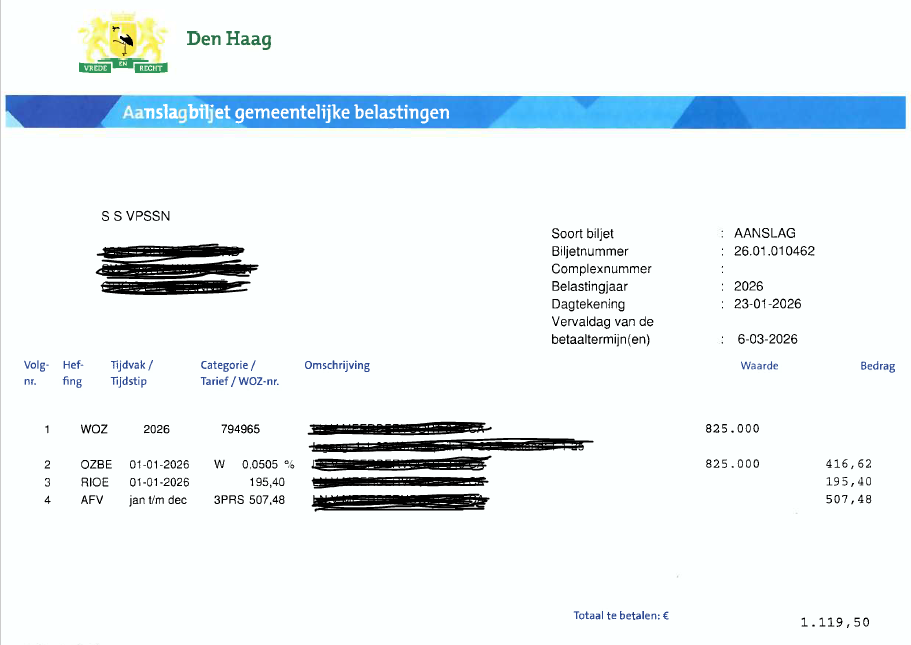

The municipality sends out the municipal tax bill ‘woonlastennota’ each year in February. It states which taxes you have to pay if you are the owner or user of a property.

If you are receiving the municipal tax bill for the first time, it might be hard to make sense of it. Below is an overview of the different types of taxes that you will find in your bill.

On your Municipal Tax bill, you will come across:

WOZ ‘waardering onroerende zaken’ - property value

The municipality determines the value of all properties in The Hague every year using property appraisals. The WOZ value is the basis for your property tax (OZB) and the water system levy for owners.

OZB ‘onroerendezaakbelastingen’ - property tax

All owners of property/properties (i.e. apartments, houses or business premises) will need to pay property tax (OZB). There are two types of properties: residential properties (OZBE) and non-residential properties, like a shop or office (OZBG).

You pay a fixed percentage of the WOZ value.

RIOE ‘rioolheffing eigenarendeel’ - sewage charge

All owners of a property (such as a home or business premises) with a direct or indirect connection to the municipal sewage system must pay the sewage charges for owners.

You pay a fixed amount per home.

If you are renting a property, you pay a fee for every 500 cubic metres of wastewater (first 500 m3 is free).

AFV ‘afvalstoffenheffing’ - waste tax

Every household in The Hague pays the waste tax. This tax covers the collection and processing of household waste. Companies and shops do not need to pay the waste tax.

There are fixed rates (i.e. 1 person, 2 persons, and 3 or more persons) for the waste tax. The amount you have to pay depends on the size of your household.

(Partial) tax exemption

Privileged people may be exempt from paying certain taxes. In general, they have to pay charges for services rendered but may be exempt from paying general taxes. For example, they have to pay the waste disposal and collection, sewerage and water treatment charges, but may be exempt from property tax and water authority tax.

What if you find a mistake, or disagree with the charges?

If you believe the municipality has made a mistake when calculating your taxes, the property value (WOZ value), or the administrative fees, you can object to invoices within 6 weeks of the date of the assessment.

Local tax calculator

You can easily calculate how much you would pay in local taxes in The Hague with this tool. You can then compare this to other Dutch municipalities. Or see what the effect is if your situation would change or if your home would have a higher or lower property value. Go to the local tax calculator (in Dutch).

More questions?

The Municipality of The Hague website explains it in more detail.